And other things I’ve learned in the last 4 1/2 years of following Ramsey, downsizing, and “living like no one else” PART FOUR

This cake has nothing to do with money. It just looks good 🙂

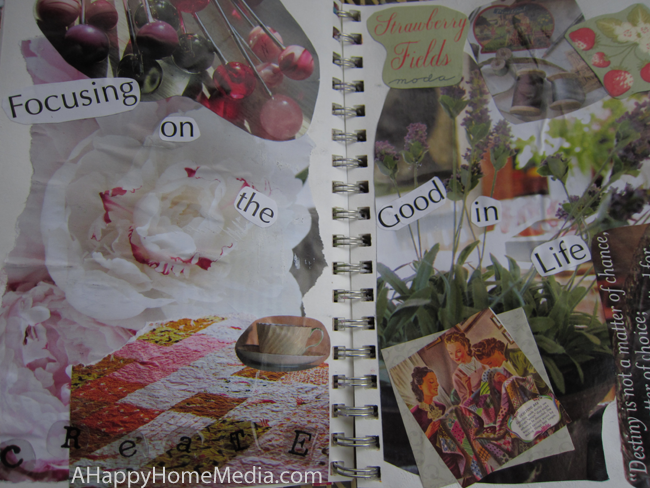

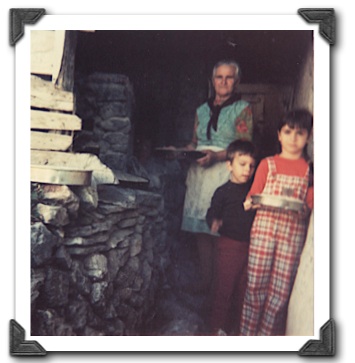

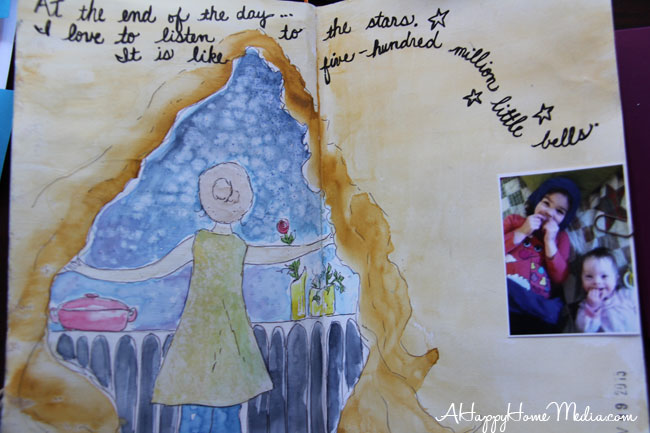

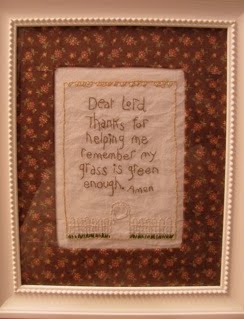

When my husband’s grandmother was still alive, we would share Thanksgiving at her table. And every year she would grab my hand and proclaim with her eyes shining, “We are SO wealthy, so very, very wealthy!” Everyone understood she wasn’t talking about her bank account, but about the family and love around the table. She was right.

So when we talk about money, we must remember that money is a tool in order to do things, both pleasurable and necessary, to have options in meeting responsibilities and goals, and to provide and leave financial help for our church and children. Being wealthy, much like generosity or lack thereof, has not so much to do with what’s in our wallets, but with what is in our hearts. And having money may make you rich, but not rich towards God, which is vastly–and eternally–most important.

Yet money is given to us to steward and to use for God’s glory. That is one reason why we were concerned with how we were managing (or not) our money, and why after decades of marriage it felt like we could never “get ahead”, despite increases in salary. Unfortunately, many people either in earnest or in jest pointed out our many children as a reason for those struggles, and although naturally there are expenses there, it was our lack of sound financial education that really hindered us. Poorly managing our money did not glorify God.

As an example of a poor education, I think the emphasis on saving money for a rainy day sounds good, but it isn’t based on reality. The reality is that generations ago, this was a super idea because every dollar was backed by something tangible and real that humans around the world valued: gold. So when you saved your money under a mattress, it was as good as saving gold. This was also the era of lifetime employment and loyal pensions, a rarity now.

Since our dollar is now not backed by anything other than “faith” in the U.S.A., and since those dollar bills are continously printed and put into the economy, prices continue to go up on a regular basis. And although we lament those prices going up, what we don’t do is sit around and say is, “Tsk tsk…there goes our dollar going down in value some more…” In other words, unlike that mattress full of money a couple of generations ago having solid value, your mattress isn’t big enough to keep feeding it money to keep up with how fast it is losing its value.

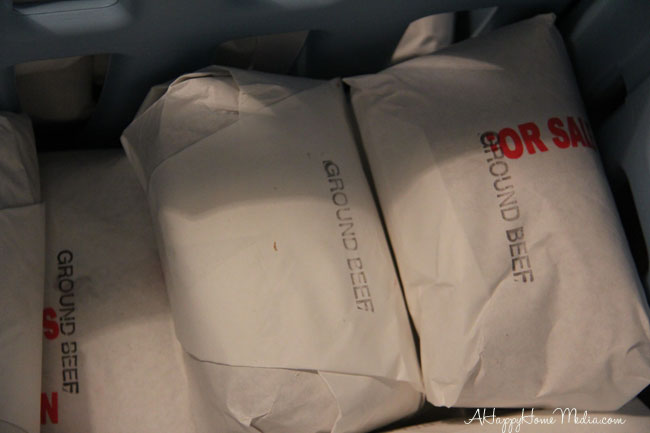

Many homesteaders know this: they see value in more tangible things (land, tools, livestock, etc.) because those are the things we need to live (shelter, food, etc.). In the event of a national emergency, economic or otherwise, those are the people who will not only survive, but thrive and rebuild the country. We see this already in Greece, where people are leaving the cities to return to the land.

The old rules also mapped out what a real education was (get a degree) and how to best retire (invest in the stock market, and expect social security payouts). It doesn’t seem a popular notion anymore that a college degree is necessary to thrive, or that social security or even the stock market is secure and guaranteed. And, besides, depending upon the governement to provide income is like having the hope that your surgery will be paid for by an insurance company should you have a terrible tumor. It’s nice to have that option if you need it and they agree to it, but who wants to need it? Futhermore, nothing from the government is “free”, whether we’re talking about education, social security, or health care. Not free financially, and not free in liberty.

So what can you do?

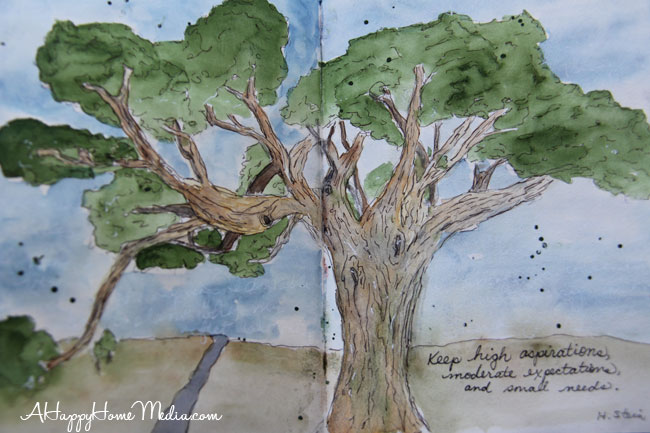

I’d encourage you to get financially educated. Read books. Listen to different podcasts with differing views. See what makes the most sense, and try to understand how wealthy people (who wrote those books) grew and continue to grow their money. Ask a lot of questions, including why you believe what you believe about money, and if those beliefs are objectively true and reality for the world you’re living in TODAY, not generations ago. And be honest: are you getting ahead? Are you happy with your financial legacy and the ability to use your own money? Can you live to 120 and not stress about running out of money? Write your own, personal questions, and seek answers.

There are many ways to have your money grow money: stock markets, real estate, precious metals, forming corporations, using whole life insurance policies, royalties, dividends, tax breaks, and probably a bunch more I don’t even know about yet. I am not an expert (obviously). The point is that there is a wide range of options beyond simply opening a saving account. It simply takes a commitment to learn, a willingness to try something different, and enough margin and honesty to play wisely.

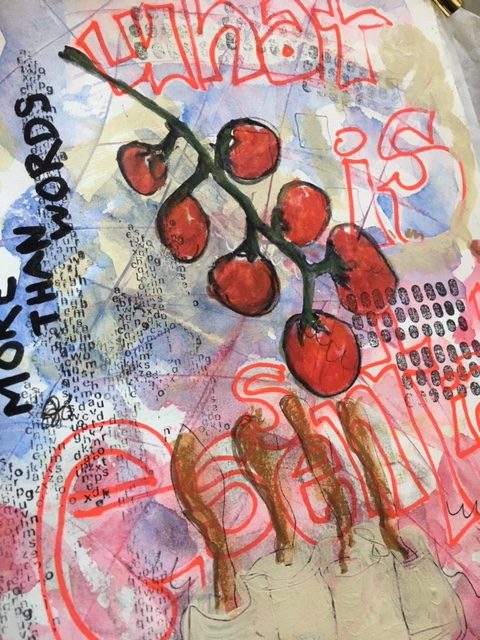

To wrap up, here are some resources that we have found valuable, in addition to the cherries we learned and still use from Dave Ramsey:

using whole life insurance policies:

https://www.life-benefits.com/

an example of thinking differently:

https://www.life-benefits.com/are-you-sure-you-should-pay-your-house-off-early/

learning about different investments/how & when

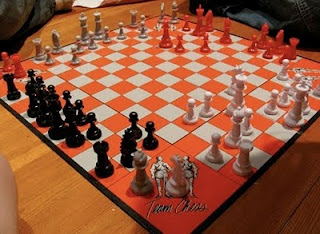

http://www.richdad.com/apps-games/cashflow-boardgame

We still have a lot to learn. Stock markets are next on my study list! I hope this has been helpful to you, and I pray that your next Thanksgiving proves very, very wealthy with all of those loved ones around your table.

Blessings,

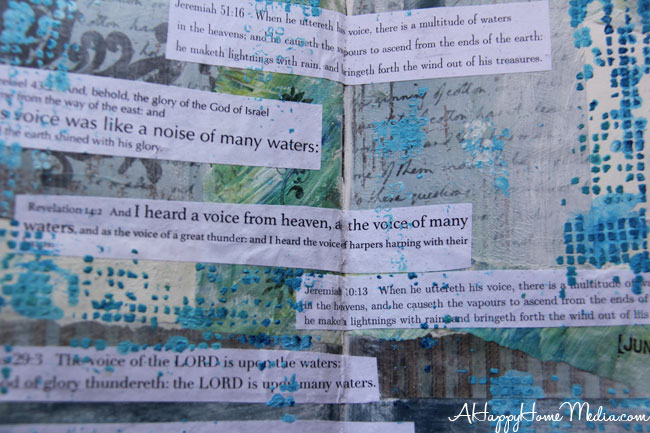

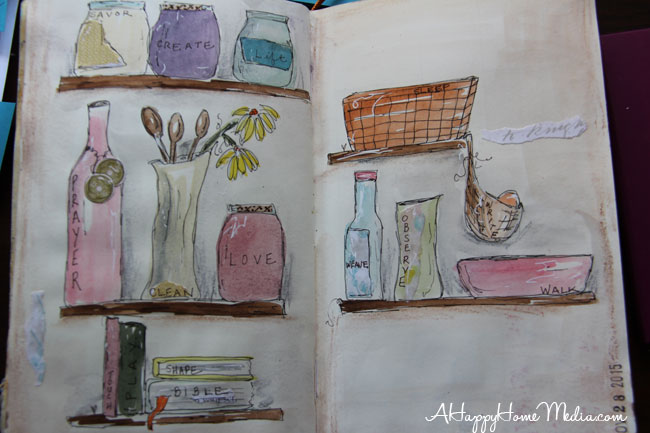

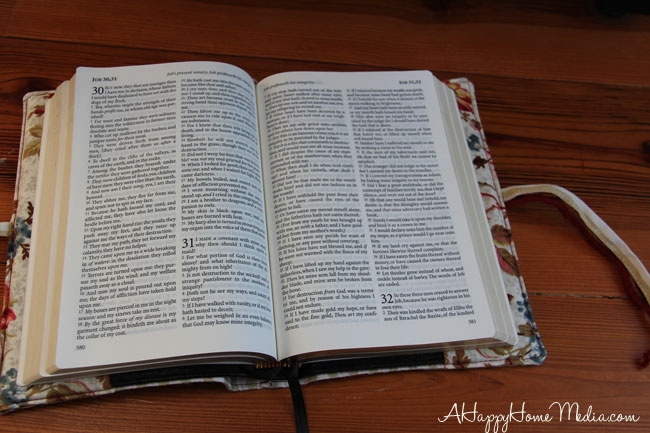

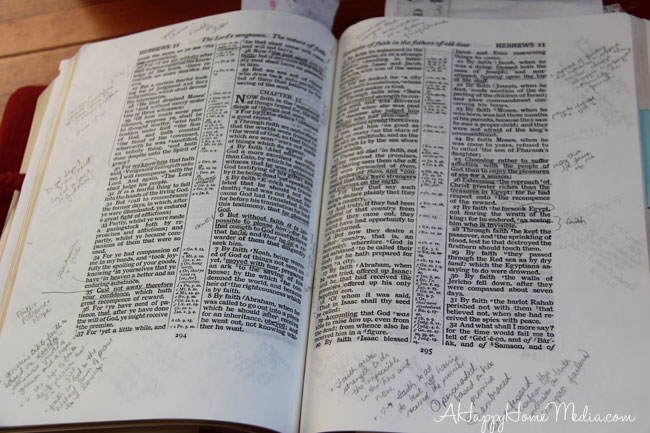

. Again, not judging anyone for their own walk, just observing mine and not liking the view. I figure if I’m bored in the evening and just want to unwind, let me crack open my Bible or pray while I knit instead of finding the laptop.

. Again, not judging anyone for their own walk, just observing mine and not liking the view. I figure if I’m bored in the evening and just want to unwind, let me crack open my Bible or pray while I knit instead of finding the laptop.

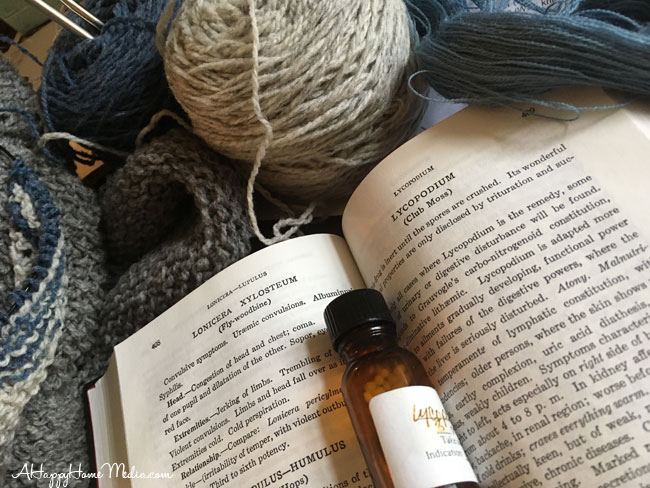

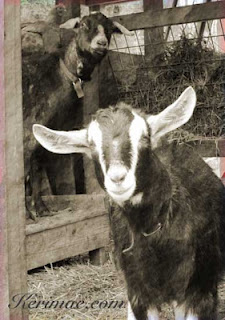

We’re currently building a small barn for our dairy goats. My husband has never built a barn before, but is doing very well using his knowledge of construction to make it happen. And me? I’ve never milked a goat in my life and although I’m enjoying the animals themselves (they’re so sweet!), my confidence isn’t exactly overwhelming.

We’re currently building a small barn for our dairy goats. My husband has never built a barn before, but is doing very well using his knowledge of construction to make it happen. And me? I’ve never milked a goat in my life and although I’m enjoying the animals themselves (they’re so sweet!), my confidence isn’t exactly overwhelming. Not so well, as you can see. Bug eaten, and not very pretty either.

Not so well, as you can see. Bug eaten, and not very pretty either.